This two part guest blog series comes to us from Sophie Eckrich, a former Whole Planet Foundation intern and founder of Teysha.

Ten years ago, I embarked for a life-changing journey as an intern for Whole Planet Foundation with their microfinance partner, Grameen Bank, in Panajachel, Guatemala. I was 19 years old, a rising Sophomore at the University of Texas at Austin, and I had no idea what to expect. I came away completely inspired by the spark of entrepreneurship created by microfinance and found in each woman I met in Guatemala, which has led to a very interesting and crazy past 10 years as I have started my own ethical fashion business, Teysha.

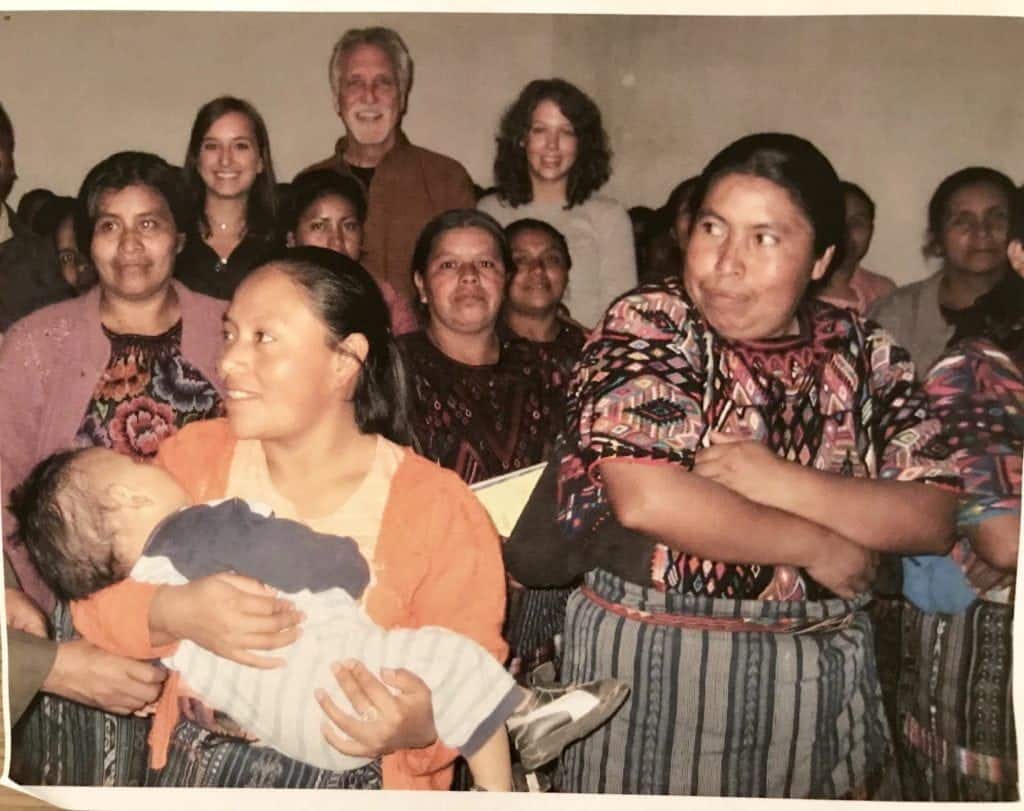

Myself, Executive Director of Whole Planet, Philip Sansone, and Chiara attending a borrowers meeting in the Chichicanstenango region of Guatemala. How amazing are their blouses?!)

Before going to Guatemala, I had spent time in rural Costa Rica and Ecuador, working for different NGOs on environmental projects. While traveling there, I met so many people who would tell me all the time that their greatest dream was to go to the USA to work. I looked around and saw the natural richness that they had: fertile land and family nearby. But, the opportunities to achieve more seemed few and far between. When I first heard of the concept of microfinance, it appeared to me the perfect solution for those who live in areas that do have resources nearby to be able to make something of those resources.

My long-time friend and fellow intern, Chiara, and I worked side by side with a multicultural team of Guatemalan and Bangladeshi representatives from Grameen Trust. The Guatemalan branch, Grameen Banrural, was only about one year old at the time, and the team wasted no time in bringing their lending services to some of the most remote areas of Guatemala. By the first year, they had thousands of women microfinance clients who each started with a loan of around $110 USD.

With then-director of Grameen Banrural, Alomgir Hossain

One of the most inspiring concepts of the Grameen model of microfinance is that of “borrowers’ groups,” who provide the social capital to guarantee the loan. Similar to many countries in Latin America, official property rights in Guatemala can be convoluted or non-existent, which is one huge barrier to accessing a traditional bank loan. The bank has nothing to guarantee the loan, and thus the person is not eligible to receive funding.

Microfinance programs innovated to solve this issue by realizing that while the women may not have traditional property rights, they had incredibly strong social ties in their community. Thus, in order to receive a loan, a woman has to create or join a network of 6-8 other women who thereby guarantee each other’s capital. You better believe if your neighbor doesn’t show up to the loan meeting for whatever reason, and that affects your ability to get a loan, that you will be the first one knocking at her door to figure out what happened and to make sure she gets back on track. This system creates mutual accountability, community, as well as a group of women who are all working to create opportunities for themselves.

That summer, we traveled throughout Guatemala visiting branches and interviewing women who had received microloans. Some women used it to start a business, such as buying livestock, and others used it to expand their existing business, such as a small convenience store or a weaving business. The women most likely did not have any formal business training, but as Muhammad Yunus, the founder of Grameen Bank, wisely said, “poor people are the world’s greatest entrepreneurs. Every day they have to innovate in order to survive.” I witnessed first hand the grit, resilience, and inspiration the microfinance clients possessed as they worked to create a better life for themselves and rise out of the situation in which they were born. The average microfinance client supported by WPF receives a loan of around $110 USD, depending on the country, and is then eligible for increasing amounts once she has repaid the loan.

Our group visiting another group of women borrowers in the community of Patzun

After my experience in Guatemala, I couldn’t get enough of the microfinance concept, so I went the following summer with another WPF client, Pro Mujer, in Peru. Pro Mujer operates on a similar model as the Grameen Bank, but adds in additional social service offerings such as child care, life insurance, and mobile health clinics to further support the needs of women entrepreneurs.

At the University of Texas, I ended up studying Sociology, with a minor in Latin American Studies and a certificate in International Development. The experience in the classroom would not have been the same without seeing, before my eyes, the process of poverty alleviation and both the complications and opportunities in the international development field. Through this experience, I learned that oftentimes, poverty alleviation is a multi-generational process. It starts with one woman, one mother, one person, who is able to incrementally better her circumstances and pass better opportunities on to her children. Those children, in turn, rise incrementally more. Everyone along the way works hard to strive for more than what they had, which is not unlike the history of most developed countries.

As I was nearing my graduation, the images and the stories of the microfinance entrepreneurs I had met in Guatemala and in Peru kept coming in to my mind. I knew that they had so many talents, so much potential, and were willing to work hard to achieve their dreams. They did not want a hand-out, they wanted an opportunity to work. I also knew that I possessed a similar entrepreneurial drive, and we could band together to create opportunities for the region. The seeds of my business, Teysha, were planted during those experiences and the inspiration tied together my Mexican heritage, my experiences with the Whole Planet Foundation, and my studies at UT. The idea of using fashion as a medium for empowerment came naturally after seeing the vast quantities of incredible textiles and artisans in Guatemala, Peru, and beyond.

Of course, a lot happens between the inspiration and the act of building the business, which I look forward to sharing more of in Part II of our series. Stay tuned to the @wholeplanet Instagram stories on July 24 as we share behind-the-scenes stories of our work in Guatemala, and keep an eye out for our soon-to-be launched artisan-made goods with the Whole Planet Foundation.